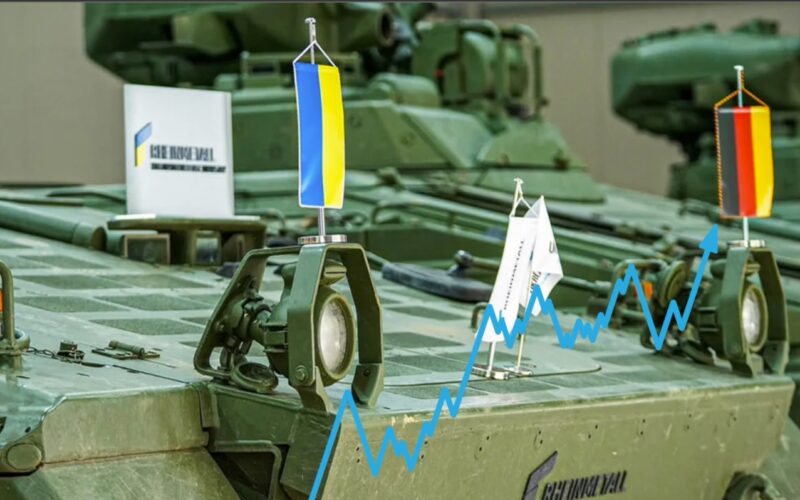

Rheinmetall, Germany’s largest defense concern, has noticeably improved its business amid Russia’s war against Ukraine. In three years, the company’s share price has increased tenfold.

A day before the start of the full-scale Russian invasion, on February 23, 2022, one Rheinmetall share cost 96.8 euros, and on February 26, 2025, it was trading on the Xetra exchange at 968 euros, DW reports.

Rheinmetall produces tanks, military trucks, artillery, anti-aircraft guns, and ammunition. The company supplies weapons to Ukraine and also profits from increased demand from NATO countries, which feel the threat emanating from Russia and, as a result, invest more in defense.

The rapid growth of the German arms manufacturers’ business is evidenced by full order books. Thus, the backlog (which includes not only existing orders but also expected deliveries under long-term contracts and potential agreements) amounted to 24.5 billion euros at the end of 2021. In the fall of 2024, this figure reached almost 52 billion euros, and the growth trend continues.

Rheinmetall will present its 2024 financial report in mid-March 2025. Shares of other defense companies, such as Hensoldt and Renk, are also highly demanded on the stock exchange.

All these funds remain in Germany and continue to work for the German economy and provide jobs. It is this kind of cooperation between Ukraine and allied countries that is most profitable and helps against Russian aggression.